Seeking Alpha

At least 50% off from FlexSub

Subscribe Now

After multiple warnings, Apple (NASDAQ:AAPL) is finally seeing the market lose interest in the slow-growing technology company as an investment opportunity. The tech giant received an artificial boost from Covid pull forwards, and it is crucial for investors to realise that new devices are not a stock saviour. My investment thesis for Apple remains bearish until the stock is completely devalued and no longer valued for strong growth.

AR/VR Hype

Apple reportedly demonstrated their new mixed reality headset to the Board of Directors on May 19. This is typically one of the final steps prior to a product launch, though it is not guaranteed.

On that day, the stock was affected by market weakness, but on May 23, Apple roared back to trade above $143. The stock is far below its yearly highs, but Apple is supported at this level only if a new AR or VR device significantly boosts sales.

Due to tough economic conditions, Apple analyst Katy Huberty recently reduced her price target on the stock from $210 to $195. The Morgan Stanley (MS) analyst lowered revenue estimates for the June quarter by 3 percent to $81.1 billion and based the price target on a PE multiple of 30.3x estimated FY23 earnings of $6.43.

These figures are from a few weeks ago, before the recent market volatility and ongoing Covid lockdowns in China. The current analyst revenue estimate for FQ3'22 is $82.8 billion, representing a modest growth of 1.7%. According to Katy Huberty's forecast, growth in the current quarter will be minimal.

A number of investors are disregarding these sluggish growth rates due to their anticipation of the release of a new mixed reality device and an AR smart glass device in 2024. Apple is not expected to generate a substantial amount of revenue from these devices compared to its current revenue base, despite the fact that there is a great deal of excitement surrounding them.

Considering that Katy Huberty had already estimated that the device would generate minimal revenue in its early years, this is not surprising. Her projection for AR/VR product revenues in FY26 is $29 billion, based on the tech titan shipping 31 million units at an average price of $750 each. Analyst Ming-Chi Kuo predicts that sales of a second-generation device will approach 10 million units in 2024. Obviously, these figures were compiled prior to the recent product delays that will likely push initial sales into early 2023.

According to prior research, it took between four and five years for Apple Watch sales to reach meaningful levels. The company didn't reach 31 million units until the fifth year after launch, in 2019, when 8.2 million more units were sold, likely aided by Covid.

Katy Huberty compared AR/VR device expectations to those of the iPad, despite the fact that this device was in much higher demand due to its productivity advantages over the iPhone. In 2011, iPad sales began with 32,3 million units and quickly surpassed $30 billion by the second year. Additionally, the average unit price in 2012 was only $329.

Katy Huberty uses an average AR/VR unit price of $750 by 2026, but many data points indicate that the initial devices will cost significantly more. The Meta Platforms Oculus Quest Pro device matching the forthcoming Apple device is priced at approximately $799. It will likely be difficult for these companies to sell mixed reality headsets at these prices.

Analyst Hype

Apple has not introduced a new device that costs close to $1,000. The hype surrounding this mixed reality product requires extreme caution from investors, and the stock won't be completely devalued until the hype subsides.

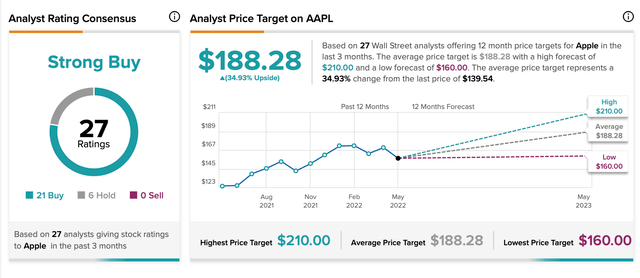

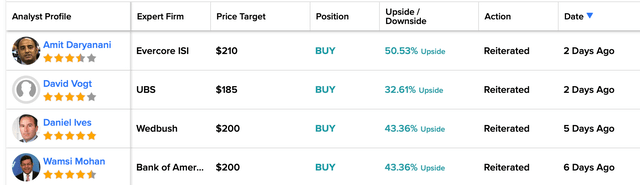

Katy Huberty has a $195 price target on the stock, based on a multiple of 30x forwards earnings per share estimates of $6.43. The average analyst has a similar price target expectation of $188.

The stock will not be devalued until prominent analysts reduce their price targets for Apple to below 20x EPS targets. Recent price declines in Snap Inc. (SNAP) and Roblox (RBLX) highlight the need for these stocks to experience a wash out.

KeyBanc Capital Markets analyst Justin Patterson lowered Snap's price target from $45 to $27, while Benchmark reduced its price target by 50 percent to $20. The stock's 52-week high is greater than $83.

The analyst at Atlantic decreased Roblox's price target to its current level. The analyst lowered the price target from $60 to $30 for a stock that, based on Covid pull forwards usage, will reach a high of over $140 by the end of 2021.

Apple's imminent demise does not even appear imminent. The previous four analyst price targets were $200, $200, $185, and $210, respectively.

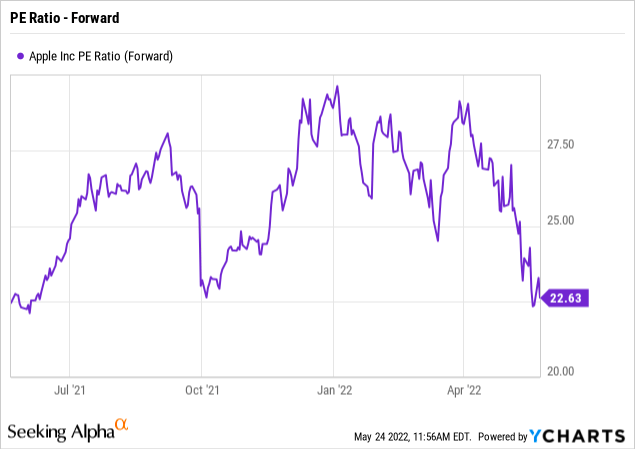

Apple does trade at the lowest forward PE multiple of the last year, but investors need to question why the $140 stock even deserves a valuation of nearly 23x forward EPS estimates. At the best, Apple is fairly valued, but remember the average analyst predicts 35% upside in the stock from here.

Apple's growth rate is not as volatile as the other tech companies mentioned in the article, so the stock does not require the same wipe out event. Snap is down 43 percent yesterday due to signs of slowing advertiser demand on the social media platform, but Apple should still trade closer to growth rates.

After FY22, analysts do not anticipate EPS growth in excess of 6%. If the stock traded at a 15x P/E, which is aggressive for these growth rates, Apple would be worth only $98 based on the estimated $6.54 EPS for FY23. In the current environment, it is possible that EPS estimates will be reduced.

Apple is unquestionably a premium company deserving of a premium valuation, but investors must recognise that a $120 valuation is indeed a premium valuation. The stock will not be wiped out until it falls to these levels and a number of influential analysts reduce their price targets significantly.

Takeaway

The key investor takeaway is that Apple isn't even close to being washed out. Not a single analyst has capitulated on the stock, yet Apple is down over $40 from the highs already. Until the stock dips to a more reasonable valuation of $120 or below and analysts start slashing price targets to match limited growth expectations, investors should avoid the stock. Apple still has too much hype premium in the stock.

Seeking Alpha

At least 50% off from FlexSub

Better, flexible and cheaper subscriptions for a wide range of services in just a click of a button.

Get started now