Seeking Alpha

At least 50% off from FlexSub

Subscribe Now

Many people are still concerned about rising gas prices. It is sometimes referred to as "the commuter tax" because many people are required to drive to work regardless of fuel prices. Many offices allowed their employees to work from home during COVID. As COVID has subsided, more offices are recalling employees or transitioning to a hybrid model, resulting in a rebound in demand.

Furthermore, while historically inelastic, fuel demand is also seasonal. Summer and fall fuel demand and consumption are higher than the colder winter and spring months.

As a result, we are rapidly approaching peak fuel demand while experiencing higher-than-usual gas prices. The average driver has experienced some discomfort at the gas pump. I hear them complaining, but two groups are not affected: the government, which continues to collect taxes, and the gas station, which passes the higher costs on to consumers.

What should we do as investors when we see strong fundamentals driving up prices? We buy the businesses that benefit! So, while others suffer at the gas pump, I own it. I get to keep a portion of the profits and reap the rewards of being an income investor.

Let's go back to our old pals, the fuel distributors, and remember that you, too, can own the pump. I should mention that they both issue K-1s at tax time.

Pick #1: GLP - Yield 8.4%

Global Partners LP (GLP) is a gasoline supplier that is vertically integrated. GLP operates three segments: wholesale, which supplies gasoline and other petroleum products to retailers, station operations, which operates convenience stores, and commercial, which supplies petroleum products to businesses.

GLP had a record quarter, with $46.4 million in DCF (distributable cash flow) available to common units, or $1.36 per unit. This is up from $27 million in the fourth quarter and $12 million in the first quarter of 2021, despite no increase in the number of units. GLP recently increased its distribution to $0.595, and it is extremely well covered.

The increase in gas prices certainly aided this beat, and we all know that high prices don't last forever, though they are likely to continue for the foreseeable future. Because those tailwinds will diminish, we cannot predict that DCF will continue to cover the distribution by nearly 230 percent.

GLP, on the other hand, is putting in more long-term growth. GLP acquired 105 new stores in the first quarter. Even if prices become less favourable, earnings will continue to rise.

We anticipate that GLP will continue to expand through acquisitions throughout the year. GLP can use its superior size and capabilities to buy out smaller operators and gain immediate cash-flow benefits in the C-store market, which is highly fragmented. The best part is that because GLP's current cash flow is so high, it can acquire without incurring additional debt or issuing new equity.

GLP will continue to make money by the bucketload for as long as the commodity boom lasts, which could be years. Meanwhile, it is expanding to ensure a more profitable future.

GLP is a partnership that issues a K-1 tax form.

Pick #2: CAPL - 10.4%

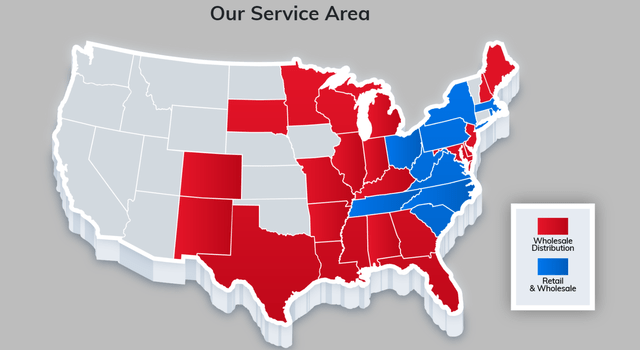

CrossAmerica Partners LP (CAPL) lives and breathes the same grounds as GLP. However, unlike GLP, CAPL is a pure-play fuel distribution and convenience store MLP.

They service over 1800 locations with gasoline and own/lease 1100 locations. This places CAPL in the same category as GLP. However, CAPL is even more focused. While GLP owns terminals and operates a heating fuel business as well, CrossAmerica Partners is strictly gasoline-focused.

CrossAmerica Partners

Currently, CAPL pays a hefty $0.525 per unit distribution with a Q1 coverage ratio of over 1.22x and a trailing twelve-month coverage of 1.33x with distributable cash flow.

We are heading directly into the Summer driving season and CAPL is well-positioned to continue its strong distribution coverage.

Since our last coverage, CAPL has been busy, they closed on the last of the locations tied to the 7-Eleven and Raceway merger, while also issuing out $25 million in privately placed preferred securities.

These actions will help keep CAPL's base assets growing. We would like to see CAPL now focus on reducing their overall indebtedness vs attempting to grow further. Unlike GLP, CAPL needs to digest its recent acquisitions in our opinion. The distribution is extremely generous and fuel demand remains strong.

Thankfully, management agrees with us. The stores they operate almost doubled in the past 12 months and they expect in the next 12-18 months to reduce their leverage ratio down from 4.9x currently to 4x-4.25x. To put this into perspective, even with the closing on the final assets and preferred issuance, CAPL dropped its leverage ratio from 5.1x to 4.9x - improvement is already occurring.

So, while CAPL focuses on reducing their leverage and absorbing all their new locations, we can enjoy their large distribution and know the gas pump is our friend, not our enemy!

Note: CAPL is a partnership that issues a K-1 at tax time.

Conclusion

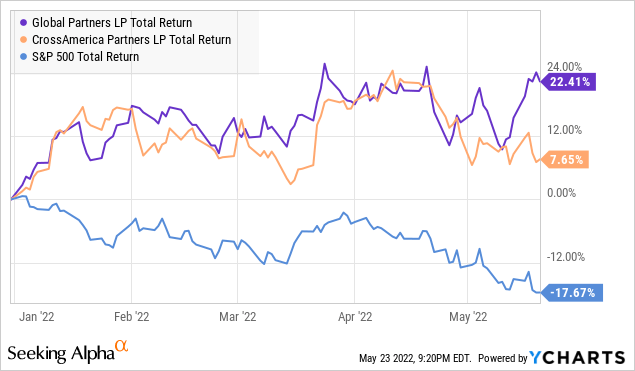

GLP and CAPL are minting cash while other sections of our economy are trying to ramp up. Rewarding shareholders even as stocks in general struggle.

GLP and CAPL have provided over 25% better returns year to date vs. the market. We expect them to continue to generate strong levels of income and to continue to outperform the market.

I love owning basic aspects of daily life, and while many are electrified vehicle apologists, the fact remains we are still living in an ICE vehicle world and will for many years to come. CAPL and GLP provide a basic service to the operation of our economy, and even if we enter a recession, gasoline will still be needed.

This means you can have your income flowing in retirement in good times or bad times. I own the gas pump, and you should too.

Seeking Alpha

At least 50% off from FlexSub

Better, flexible and cheaper subscriptions for a wide range of services in just a click of a button.

Get started now